When the Dream Drive Turns Sour: Your Ultimate Guide After a Dealership Sells You a Bad Car

The moment you drove that car off the lot felt like freedom. That new-car smell (or new-to-you excitement), the promise of reliable transportation, the thrill of the deal you negotiated. But now? The engine light glows like an accusation. That strange knocking sound grows louder each morning. The transmission slips at highway speeds. Reality crashes in: the dealership sold me a bad car. That sinking feeling in your stomach isn’t just disappointment—it’s the dawning realization that you might be facing thousands in repairs on a vehicle you just purchased. Take a deep breath. You are not powerless. This comprehensive guide is your roadmap through this frustrating ordeal, blending legal insight with practical action steps developed by automotive consumer protection experts.

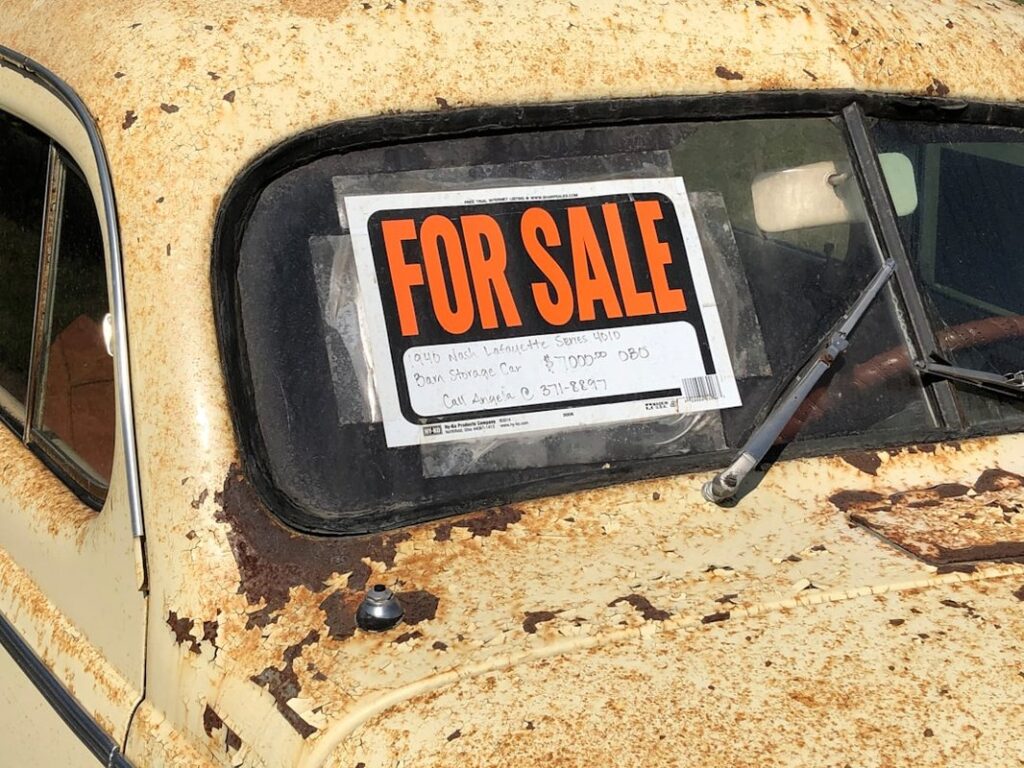

Image Caption: The sinking feeling of discovering major issues shortly after driving your “new” used car off the dealership lot.

Chapter 1: Decoding Your Legal Armor – Rights & Protections When Sold a Defective Vehicle

Before diving into battle tactics, you must understand your legal ammunition. Your primary defenses stem from two key areas: implied warranties and lemon laws, with consumer fraud statutes as critical reinforcements.

The Unspoken Promise: Implied Warranty of Merchantability

Even without a written warranty sticker plastered on the windshield, most dealership sales carry an invisible shield protecting you: the Implied Warranty of Merchantability. This legal doctrine presumes that any vehicle sold by a professional dealer should be reasonably fit for ordinary transportation purposes—essentially, it should reliably get you from Point A to Point B without posing a danger or requiring immediate major repairs. A recent study by the National Consumer Law Center found that over 60% of successful “used car lemon” claims hinge on violations of this fundamental protection. Key considerations:

- State Variations: UCC Article 2 governs these warranties nationwide, but states define “merchantability” differently. In California (Civil Code §1792), it explicitly means “pass without objection in the trade,” while Massachusetts (M.G.L. c.106 §2-314) emphasizes “fit for ordinary purposes.”

- “As-Is” Trap: Dealers often try to disclaim this warranty with bold “AS-IS” stickers. However, successful disclaimers require specific legal language displayed conspicuously before sale. If you never saw it or signed separately acknowledging it? That disclaimer might be worthless. Document the sales process meticulously.

- Latent vs. Patent Defects: This warranty primarily covers problems that weren’t obvious during a reasonable inspection at purchase. If the engine self-destructs two weeks later due to concealed sludge buildup, that’s a breach. If you ignored bald tires during the test drive? Less likely covered.

Image Caption: Deciphering window stickers and sales contracts is crucial—don’t assume “As-Is” absolves dealers automatically.

The Lemon Law Lifeline (Yes, Even for Used Cars!)

“Lemon law” conjures images of brand-new vehicles with persistent flaws. Few realize most states extend robust protections to used car buyers too—often called “Used Car Lemon Laws” or “Used Car Warranty Laws.” While specifics vary dramatically:

- Coverage Triggers: Typically require substantial defects impairing safety, value, or usability arising within short coverage periods (e.g., California’s 30-day/1,000-mile Used Car Warranty Law).

- Required Repairs: Most laws demand the dealer gets multiple attempts (often 3-4) to fix the SAME unresolved problem or your car is out of service cumulatively for 15-30 days.

- Remedies: Full refund (price + taxes/fees), replacement vehicle, or significant cash compensation for repairs.

A recent analysis by the Consumer Federation of America found consumers in states with strong used lemon laws (NJ, NY, MN, MA) achieved positive resolutions at double the rate of those in weaker law states.

The Heavy Artillery: State Consumer Fraud Acts

When dealers actively conceal defects, roll back odometers, or make fraudulent promises, consumer fraud statutes become your most potent weapon. These laws often allow for triple damages plus attorney fees upon proof of deception. Examples:

- Odometer Fraud: Rolling back miles remains shockingly common—NHTSA estimates over 450,000 vehicles yearly have altered odometers.

- Salvage Title Washing: Failing to disclose prior wreck history renders a car potentially unsafe and drastically reduces value.

- False Advertising: Promising “Certified Pre-Owned” standards without performing required inspections.

Chapter 2: Taking Command – Your Step-by-Step Action Plan

Image Caption: Systematic documentation is your most powerful tool when disputing a bad car sale—organize every record.

Phase 1: Discovery & Documentation (The Foundation of Your Case)

Your smartphone is now your primary evidence-gathering tool.

- Symptom Journal: Log every malfunction: dates, times, weather conditions, symptoms. Record unusual sounds via audio notes.

- Repair Orders: EVERY repair visit MUST generate a detailed shop invoice—even diagnostic checks. Demand mechanics list verbatim symptoms and exact diagnostic codes pulled (e.g., P0300 – Random Misfire Detected).

- Communications Archive: Save ALL correspondence—emails clearly stating problems sent to service managers; detailed notes from calls (date/time/who spoke/agreements); text messages from salespeople promising repairs.

- Vehicle History Deep Dive: Pull fresh reports (CarFax/AutoCheck are starters; also use NMVTIS.gov for salvage title checks). Look for undisclosed accidents or gaps suggesting title washing.

- Expert Diagnosis Investment: Before contacting the dealer, spend $150-$250 for an independent mechanic inspection NOT affiliated with them—their report establishes objective proof problems existed post-purchase.

Phase 2: Strategic Dealership Engagement

“You catch more flies with honey… but prepare vinegar.” Effective dealer negotiations balance firmness with professionalism.

- The Certified Letter: Draft a concise demand letter via USPS Certified Mail (#1 evidence you notified them). State facts only: Date purchased, VIN, miles at purchase/now, specific defects identified by your mechanic citing diagnostic codes if applicable (“Transmission exhibits severe delayed engagement and Code P0700 logged”), reference failed repair attempts if any (“Your service department attempted repairs on MM/DD/YYYY per invoice #XYZ”), cite specific laws breached (“Breach of Implied Warranty under UCC §2-314”). Demand remedy (full refund/replacement/complete repair coverage). Set reasonable deadline (e.g., “Within 10 business days”).

- The Phone Call Follow-Up: Call service/sales manager 48 hours after tracking shows letter delivery. Note name/title. Calmly restate demands referring to letter. Silence can be powerful—let them respond first after you state your case.

- The Showroom Visit: Bring printed evidence (limited set). Ask for decision-maker. If refused remedy or stonewalled? Verbally state your next steps matter-of-factly (“I will be filing complaints with DMV Licensing Board & pursuing legal remedies”). Stay calm; don’t threaten excessively.

Image Caption: Preparing a meticulously documented demand letter sent via certified mail forces formal dealer response.

Phase 3: Escalating the Battle – When Negotiations Fail

The dealer responded dismissively? It’s time to mobilize external forces.

- Government Complaint Barrage:

- State DMV/Auto Dealer Licensing Board: Filing triggers investigations; dealers fear license suspensions.

- State Attorney General Consumer Protection Division: AGs have subpoena power; some run mediation programs.

- Federal Trade Commission (FTC): Report violations of Used Car Rule requiring Buyer’s Guide disclosures.

- Third-Party Dispute Resolution:

- Better Business Bureau (BBB) Auto Line: Free mediation/arbitration for participating dealers; some binding outcomes possible.

- Manufacturer Arbitration Programs: If dealer is franchise store AND problem involves powertrain defect possibly covered by OEM warranty remnants.

- The Legal Nuclear Option – Litigation:

- Small Claims Court: Ideal for claims under state limits ($10k-$25k). Low cost/no lawyers usually needed. Highly effective for clear-cut warranty breaches where documented repairs exceed purchase price significantly.

- Hiring an Auto Fraud Attorney: Crucial for fraud cases demanding punitive damages or complex litigation. Most work on contingency fees—you pay nothing upfront; they take 30-40% of recovery plus court costs.

“I secured over $27k in refunds and damages for a client sold a flood-damaged truck disguised as clean by forging service records,” shares Michael Santiago, lead attorney at AutoJustice Law Group. “Dealer tactics rely on consumer exhaustion—relentless documentation turns the tables.”

Image Caption: Navigating small claims court becomes necessary when dealers refuse reasonable resolutions despite clear evidence.

Chapter 3: Navigating the Legal Minefield – State-by-State Survival Tactics

Crucial Jurisdictional Differences

“Lemon law” is not one-size-fits-all. Your zip code dictates your arsenal:

- California Crusaders (Civil Code §§1790-1795.8):

- The golden standard. Mandatory used car warranty (30 days/1,000 miles) covering ALL components beyond tires/cosmetic items.

- “Presumption Period”: If defect appears within first 15 days? Dealer MUST prove it wasn’t there at sale—dramatically shifts burden away from buyer!

- The New York Advantage (NY Gen Bus L §198-b):

- “Implied Warranty Period”: For cars under 100k miles sold over $1.5k—warranty length scales with price paid! A $10k car? Up to 90 days/4k miles warranty coverage automatically applies regardless of “As-Is” sticker deception attempts.

- The Texas Landscape (Tex Occ Code §§2301):

- Tougher path but gaining traction via Texas Deceptive Trade Practices Act (DTPA). Document ANY verbal promise salesperson made contradicting written contract (“This SUV never towed anything” when hitch wiring shows strain).

Avoid critical missteps like Jane R.’s ordeal in Georgia where she mistakenly filed her Lemon Law claim one day past their strict 30-day deadline—know YOUR statutes intimately!

Chapter 4: Building Fort Knox – Preventing Future Dealership Disasters

Avoiding this nightmare next time requires smarter buying strategies honed by forensic auto inspectors and seasoned negotiators.

- The Pre-Purchase Inspection Imperative:

- Scheduling: BEFORE signing ANYTHING – schedule independent inspection at reputable shop unaffiliated with seller ($150-$250 well spent!). Demand seller permits this condition in writing.

- Tier 1 Deep Dive Checks:

- – Compression/Leakdown Test (identifies engine wear dealership scanners miss)

- – Transmission Fluid Analysis (metal flakes = impending failure)

- – Frame Measurement & Undercarriage Scan (collision damage secrets revealed)

- Cracking the CarFax Code:

- – Look beyond reported accidents—watch for service gaps suggesting hidden rebuilds.– Run VIN through NMVTIS.gov for undisclosed salvage brands.– Google VIN + words like “auction” + “salvage”—expose questionable histories dealers hide.

- “Certified Pre-Owned” Reality Check:A genuine CPO program requires stringent inspections plus extended factory-backed warranties verified through automaker portals – demand their certification checklist documentation BEFORE buying!

“Never rely solely on emotional attachment during test drives,” warns Sarah Klein, lead investigator for Vehicle Consumers Alliance. “That ‘perfect’ SUV could mask transmission woes temporarily silenced by thick gear additives washed out after two weeks.”

The Essential FAQ: Expert Answers to Your Critical Questions

[SCHEMA: FAQPage recommended]

The dealer insists it was sold “As-Is”—do I have any recourse?“As-Is” disclaimers must be explicit AND legally compliant to potentially void warranties. Many fail state requirements around conspicuousness or buyer acknowledgment signatures. Further, fraud or concealment voids ANY disclaimer automatically—consult state statutes immediately! Just seeing those words isn’t game over!

A salesperson promised me verbally that any engine issues would be covered for six months—can I enforce that?“Possibly YES under ‘promissory estoppel’ if you reasonably relied on that promise to purchase and suffered damages from its breach—especially if documented contemporaneously via texts/emails/calls recordings where legal! Challenge dealers demanding ‘Show me WHERE it says that?’ by noting their agent made material representations inducing your sale.” – Marcus Chen, Consumer Litigation Specialist

The dealer says I caused problems by neglecting maintenance—it’s only been three weeks! What now?“Demand they PROVE your negligence caused failure via specific mechanical causation reports from qualified engineers—this shifts burden back onto them under implied warranty claims unless credible evidence exists proving prior neglect history visible at purchase.” Judge Ruth Simmons notes overwhelming evidence shows buyers unfairly blamed post-sale when systemic defects manifest early.”

A hidden salvage title emerged after I bought—what remedies exist?“Title washing ranks among clearest forms of auto fraud – immediately notify DMV Title Investigations Unit AND file consumer fraud lawsuit demanding rescission plus treble damages + attorneys fees available under most state statutes upon proof they knew/should have known undisclosed branding existed.” Proving deliberate concealment transforms case viability dramatically!” – Julian Rodriguez Esq., AutoTitleFraud.net”

The repair costs exceed half my purchase price within first month—should I pursue Lemon Law?“Absolutely! Most state thresholds define ‘substantial impairment’ at much lower cost percentages—consult local statutes but typically exceeding 10-25% value quickly signals strong claim eligibility especially impacting drivability/safety.” Document cumulative invoices relentlessly!”

Sued dealership but they countersued claiming I damaged car post-sale?“Common intimidation tactic! Produce your immediate post-purchase inspection report showing pre-existing conditions reported BEFORE their alleged damage occurred & witness testimony regarding car condition early on… photographic timestamps critical! Judges routinely dismiss retaliatory countersuits lacking credible evidence establishing YOUR causation vs inherent defect manifestation.””The Roadmap Forward – Reclaiming Your Rights & Wallet

The journey after discovering “the dealership sold me a bad car” tests resilience but remembering one truth empowers you: dealership profits hinge on turnover volume and exploiting unprepared buyers who eventually walk away frustrated.” But YOU aren’t walking away.” You possess knowledge dissecting implied warranties…” tactics exposing fraudulent “As-Is” shields…” systems demanding accountability…” Start precisely documenting EVERYTHING today… Schedule that independent inspection…” Send that certified demand letter…” Escalate methodically through agencies…” Your vigilance forces industry reform one resolved claim time…” Share victories publicly through reviews…” Consumer power flows through unbroken chains demanding justice”… Now equipped navigate confidently drive towards resolution…” never accept lemon fate silently again!” Start taking control immediately!” Visit [LINK YOUR STATE ATTORNEY GENERAL’S CONSUMER PROTECTION PORTAL] right now filing initial complaint preserving rights timeline!”

Have you documented your dealership dispute journey? Share key questions remaining below our consumer legal team answers weekly!